Introduction

The digital payments landscape is constantly evolving, and DigiPay has emerged as one of the prominent tools facilitating this transition. It empowers users, especially in rural and semi-urban areas, with easy access to digital financial services. This article will explore DigiPay in detail, covering its features, benefits, challenges, and impact on financial inclusion.

Table of Contents

What is DigiPay: DigiPay

DigiPay is a digital payment solution developed to promote financial inclusion, especially in areas where banking infrastructure is minimal. Managed by organizations and fintechs in various countries, DigiPay often collaborates with government bodies to provide secure, accessible digital transactions. Designed to streamline transactions, DigiPay caters primarily to underserved communities, making financial services available at their doorstep.

How DigiPay Works

DigiPay functions through a combination of digital kiosks, agents, and mobile apps, depending on the location and availability of resources. Here’s an overview of how DigiPay operates:

Registration and Setup

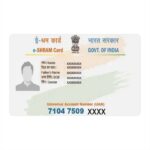

To begin using DigiPay, users must register by providing their identification details. This may include Aadhaar (in India) or similar national ID cards in other countries. Registration can be completed through an agent, at a kiosk, or via a mobile app.

Transactions and Services

DigiPay offers a variety of services such as:

- Cash Withdrawals: Users can withdraw cash at designated kiosks or through DigiPay agents.

- Deposits and Savings: DigiPay allows users to deposit funds, making it easy to save money digitally.

- Bill Payments: Utility bills, taxes, and other government fees can be paid using DigiPay.

- Money Transfers: DigiPay enables peer-to-peer transfers, allowing users to send money across the country.

Biometric Authentication

DigiPay’s unique feature is its biometric authentication, ensuring secure transactions. Users authenticate their transactions through biometric data (fingerprints or iris scans), reducing the risk of fraud and providing a simple interface.

Key Features of DigiPay

DigiPay offers a range of features that make it a unique and valuable tool in the digital payments ecosystem:

1. Accessibility

DigiPay agents are strategically located in rural and semi-urban areas, allowing people without access to traditional banking to access financial services easily.

2. Security

With biometric authentication, DigiPay provides enhanced security. The use of advanced encryption also ensures that transactions remain safe from potential fraud.

3. Real-time Processing

Transactions are processed in real-time, allowing users to access funds instantly or pay for services without delays.

4. Affordable Fees

DigiPay keeps transaction fees minimal, making it an affordable option for people in low-income areas.

Benefits of DigiPay

DigiPay provides numerous advantages that contribute to its popularity among underserved populations:

Financial Inclusion

DigiPay enables financial inclusion by reaching people who have been traditionally underserved by banking institutions. Its presence in remote areas bridges the gap between urban and rural financial access.

Convenience and Flexibility

The DigiPay model allows users to perform transactions at any time, making it flexible for users. DigiPay agents are available in local markets, making it convenient for customers who cannot travel far.

Cashless Transactions

Promoting cashless transactions, DigiPay reduces the dependency on physical cash and minimizes the risks of carrying cash. This shift to digital can potentially reduce the cost and inconvenience associated with handling cash.

Economic Empowerment

By providing accessible financial tools, DigiPay empowers people to manage their finances better, save money, and participate more fully in the economy.

Challenges Faced by DigiPay

Despite its advantages, DigiPay faces some challenges in implementation and operation:

Limited Internet Connectivity

In rural areas, limited internet connectivity can hinder the effectiveness of DigiPay. Real-time processing is difficult in locations with low-speed or intermittent internet.

Digital Literacy

A lack of digital literacy among users poses a challenge. Many rural users may not be familiar with digital interfaces, requiring extensive user education and support.

Financial Frauds and Cybersecurity

While biometric authentication minimizes fraud, cybersecurity remains a concern. Fraudsters continuously look for ways to exploit digital payment systems, and DigiPay must stay vigilant.

Agent Availability and Training

Maintaining a network of well-trained agents in remote areas is challenging. Proper training and retention of agents are essential to deliver seamless services, but agent turnover and training costs are high.

DigiPay vs. Traditional Banking

DigiPay provides services similar to traditional banking but with a focus on accessibility and digitalization. Here’s a comparison:

| Aspect | DigiPay | Traditional Banking |

|---|---|---|

| Accessibility | Available in rural and remote areas, often through agents | Limited to bank branches |

| Transaction Fees | Minimal fees for basic services | Varies; can be higher |

| User Interface | Simple and user-friendly | May be complex for new users |

| Authentication | Biometric (fingerprint/iris) | Often requires physical ID |

| Speed | Instant transactions | Can involve processing delays |

How to Use DigiPay

For new users, getting started with DigiPay involves the following steps:

Step 1: Find a DigiPay Agent

Locate a nearby DigiPay agent or kiosk. You can find information on agents through the DigiPay website or app.

Step 2: Register with Identification

Provide necessary identification documents, such as an Aadhaar card or another national ID, for verification and biometric registration.

Step 3: Perform Transactions

Once registered, you can begin transactions. Simply visit the agent, authenticate your request biometrically, and conduct your required transaction.

Step 4: Monitor Transactions

You can track your transactions through the DigiPay app or by requesting transaction summaries from agents.

DigiPay and Government Initiatives

DigiPay often collaborates with government initiatives to improve financial inclusion. In India, for example, DigiPay is part of the government’s Digital India mission, promoting cashless transactions and providing benefits for government schemes like pension disbursements and social welfare payments.

The Future of DigiPay

As digital finance continues to grow, DigiPay is likely to expand its reach and offerings. Some trends expected in DigiPay’s evolution include:

Integration with New Technologies

With advances in blockchain, artificial intelligence, and machine learning, DigiPay may integrate these technologies for better security, faster processing, and user customization.

Expansion of Services

DigiPay may expand into microloans, insurance, and investment options, providing users with a broader suite of financial products.

Increased Focus on Digital Literacy

To ensure everyone can use DigiPay effectively, future initiatives may focus on improving digital literacy through educational programs and simplified interfaces.

Collaborations with Banks and Fintechs

Partnerships with banks and fintech companies will help DigiPay broaden its service offerings and gain expertise in delivering complex financial services to underserved populations.

Conclusion

DigiPay has made digital finance accessible to millions who previously lacked financial services. It provides an affordable, convenient, and secure way for users to transact, save, and pay bills. Despite challenges like connectivity and cybersecurity, DigiPay remains a cornerstone for financial inclusion, especially in remote areas. The future of DigiPay is promising, with potential growth in services, technology integration, and partnerships, ensuring that digital finance becomes a reality for all.